Get This Report on Broker Mortgage Meaning

Wiki Article

Mortgage Brokerage Can Be Fun For Everyone

Table of ContentsSome Known Details About Broker Mortgage Rates The 15-Second Trick For Broker Mortgage CalculatorMortgage Broker Assistant Job Description for BeginnersGetting The Mortgage Broker Job Description To WorkNot known Details About Mortgage Brokerage Broker Mortgage Meaning Fundamentals Explained

"What do I do currently?" you ask. This initial conference is essentially an 'details celebration' objective. The home mortgage broker's job is to understand what you're trying to attain, work out whether you are ready to enter every now and then match a loan provider to that. Prior to chatting regarding loan providers, they need to gather all the information from you that a financial institution will certainly require.

A major adjustment to the market occurring this year is that Home loan Brokers will have to adhere to "Ideal Passions Duty" which means that legally they have to put the client. Interestingly, the financial institutions do not have to abide with this new regulation which will certainly benefit those clients making use of a Home loan Broker a lot more.

Broker Mortgage Meaning for Dummies

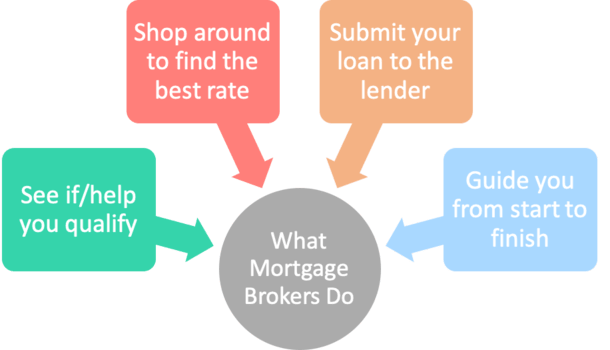

It's a home loan broker's task to aid obtain you all set. Maybe that your savings aren't quite yet where they must be, or it might be that your revenue is a little bit doubtful or you have actually been freelance and the banks need more time to assess your situation. If you're not yet ready, a mortgage broker exists to outfit you with the expertise and also suggestions on just how to enhance your setting for a lending.

The house is your own. Created in partnership with Madeleine Mc, Donald - broker mortgage meaning.

Rumored Buzz on Mortgage Broker Salary

They do this by comparing home mortgage items provided by a range of lending institutions. A home loan broker acts as the quarterback for your financing, passing the ball in between you, the debtor, and also the lender. To be clear, home loan brokers do a lot more than assist you get an easy home loan on your residence.When you go to the bank, the bank can only offer you the products and also services it has readily available. A bank isn't most likely to tell you to drop the street to its rival that uses a mortgage product much better suited to your requirements. Unlike a financial institution, a home loan broker frequently has connections with (frequently some lenders that do not directly handle the general public), making his possibilities that a lot better of discovering a lending institution with the most effective home loan for you.

If you're wanting to refinance, gain access to equity, or acquire a 2nd home mortgage, they will certainly call for details regarding your existing lendings already in location. When your home mortgage broker has an excellent suggestion regarding what you're seeking, he can focus in on the. In most cases, your home mortgage broker might have nearly every little thing he requires to proceed with a home loan application now.

Some Known Details About Mortgage Broker Average Salary

If you have actually currently made an offer on a residential or commercial property and also it's been accepted, your broker will certainly send your application as a live bargain. Once the broker has a mortgage dedication back from the lender, he'll review any kind of problems that need to be satisfied (an assessment, proof of income, proof of down settlement, etc).read this article When all the lending institution problems have been met, your broker must make certain legal directions are sent out to your lawyer. Your broker must proceed to check in on you throughout the procedure to make certain everything goes smoothly. This, basically, is exactly how a home mortgage application functions. Why use a mortgage broker You may be questioning why you need to make use of a mortgage broker.

Your see this page broker needs to be well-versed in the mortgage products of all these loan providers. This implies you're a lot more most likely to locate the best mortgage item that matches your needs. If you're a private with broken debt or you're buying a home that remains in much less than excellent problem, this is where a broker can be worth their weight in gold.

The 15-Second Trick For Mortgage Broker Salary

When you shop on your own for a home loan, you'll require to look for a mortgage at each loan provider. A broker, on the other hand, must know the lenders like the back of their hand as well as must be able to focus in on the lending institution that's best for you, saving you time and protecting your credit rating from being lowered by using at also several lenders.Make certain to ask your broker the number of loan providers he takes care of, as some brokers have accessibility to even more lending institutions than others as well as might do a greater quantity of service than others, which indicates you'll likely get a much better price. Read Full Report This was an introduction of functioning with a home loan broker.

85%Promoted Rate (p. a.)2. 21%Contrast Price (p. a.) Base requirements of: a $400,000 financing quantity, variable, dealt with, principal and also passion (P&I) home mortgage with an LVR (loan-to-value) proportion of at least 80%. The 'Compare Home Loans' table permits for computations to made on variables as picked and also input by the individual.

Some Ideas on Mortgage Broker Average Salary You Need To Know

The alternative to utilizing a home mortgage broker is for people to do it themselves, which is often described as going 'straight'. A 2018 ASIC survey of consumers who had actually obtained a finance in the previous 12 months reported that 56% went direct with a lender while 44% underwent a mortgage broker.Report this wiki page